Mobile Wallets: What & How

A mobile wallet is a way to carrycash in digital format. You can link your credit card or debit card information

in mobile device to mobile wallet application or you can transfer money online

to mobile wallet. Instead of using your physical plastic card to make

purchases, you can pay with your smartphone, tablet, or smart watch. An

individual's account is required to be linked to the digital wallet to load

money in it. Most banks have their e-wallets and some private companies. e.g.

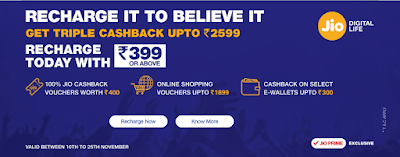

Paytm, Freecharge, Mobikwik, Oxigen, mRuppee, Airtel Money, Jio Money, SBI

Buddy, itz Cash, Citrus Pay, Vodafone M-Pesa, Axis Bank Lime, ICICI Pockets,

SpeedPay etc.

- Option to open Zero KYC or Full KYC wallet

- Option of Consumer vs. Merchant wallet

- Mobile Number

- An App to be downloaded in smart phone

Service Activation:

- Load money (subject to regulatory limits) using internet banking or merchant locations

- Bank A/c

- All Cards

- Cash-In

What is required for Transaction:

- Smartphone or internet

- Use MPIN

- Self-service and/or Assisted mode

Transaction Cost:

- Customer pays for remittances to bank a/c @ 0.5%-2.5% of fixed fee.

- May pay for data charges in self-service mode.

Disclaimer: The transaction costs

are based on available information and may vary based on banks.

Services Offered:

- Balance Enquiry

- Passbook/ Transaction history

- Add money

- Bank A/c

- All Cards

- Cash-In

- Accept Money

- Pay money

- Another wallet (mobile no.) with same provider

- Pay merchant

- Bar Code reader

- Manage Profile

- Notifications

Funds Transfer limit:

- For Users

- No KYC - Rs 20,000/ month (revised from Rs 10,000 to current till 30th Dec. 2016)

- Full KYC – Rs 1,00,000/- month

- For Merchants

- Self-Declared - Rs 50,000/ month

- With KYC – Rs 1,00,000/- month

Disclaimer: The funds transfer

limits are based on available information and may vary based on banks.

Service Available from no. of

operators:

- 40 companies

- No Cash-Out

- Non-interoperable

Comments